Banking institution CABS, a member of Old Mutual Zimbabwe, sustained regional and international credit lines worth US$107 million in the interim period to June 30, 2024, which was largely for on-lending to key economic sectors.

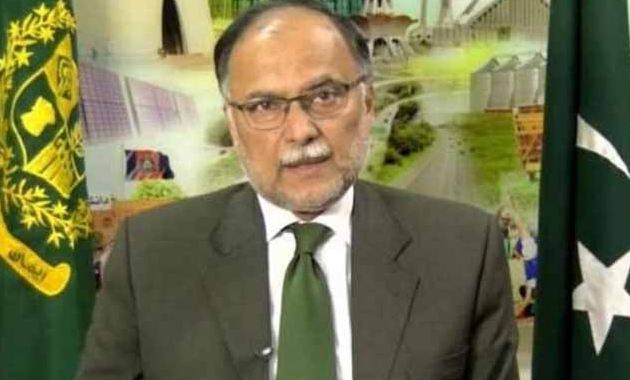

Old Mutual Zimbabwe chief executive Mr Samuel Matsekete, in a presentation of group financials, said the agriculture sector remained the largest beneficiary of the loans at 29 percent, followed by energy at 10 percent and mining at 8 percent.

“For the banking business line, we sustained international lines of credit that we established in the previous periods and continued to grow that, so you will see us continuing to talk to the funders that we have in our books, and we are appreciative of their support,” he stated.

Mr Matsekete said there has been growth in lending towards retail and commercial services sectors, which have been targeted, as well as the value chain being supported by the growth of the sectors.

He noted that the overall non-performing loan (NPL) ratio remained within target at 0,9 percent.

During the period under review, he reported that the bank’s US dollar deposits declined to 81 percent from 92 percent during the same period in 2023.

“But on the lending side, there is a huge preference by the market to borrow in US dollars again, and that would reflect 95 percent of our book going up from the previous level.

“The mix of our lending book in a way reflects some of the risks that we are seeing between sectors, like agriculture coming down marginally with the effect of El Nino, and our portfolio has to respond to some clients to ensure that the exposures we carry were supported by the assessment of the sectors that we support,” said Mr Matsekete.

He noted that within the transactional space, the bank maintained its leadership position in the market space of point-of-sale services at 32 percent.

Mr Matsekete said in terms of capabilities, the bank continues to evolve with the introduction of services such as deposit-taking ATMs as well as specialised branches.

“We have introduced a special NGO branch, a digital service centre, and this thrust is really reflecting how we need to ensure that we future-proof our platforms and respond to the needs of the customers,” he disclosed.

Mr Matsekete said the bank also continued to invest in technology platforms, and the business’s capital adequacy is an indicator of its capabilities.

During the period under review, the bank recorded a surplus of Zig110,3 million while the net interest margin remained positive at 6,4 percent.

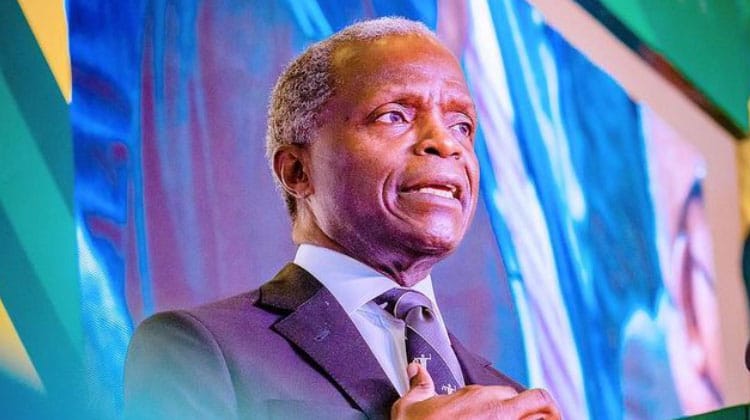

Group managing director Mr Mehluli Mpofu, in a statement of the financials for the bank, said the performance demonstrated resilience in the reporting period in an environment characterised by high Zimbabwe dollar inflation in the first quarter of the year.

He said net interest income for the bank was 33 percent lower at Zig78,96 million, while fee and commission income increased by 55.64 percent.

“The variances between the two comparative periods have been influenced by the impact of the application of IAS 29 on prior year numbers,” he said.

Mr Mpofu noted that the bank recorded a 4,2 percent growth on the balance sheet, mainly due to credit line draw-downs amounting to US$34 million.

The managing director said on investing in innovation, the society continues to foster agile innovation through its transformation programmes to enhance customer experience and improve efficiencies in processes through process optimisation and automation.

Mr Mpofu stated during the first half of 2024, the society introduced several projects to enhance customer experience through the use of digital platforms.

Some of the initiatives include session resumption on USSD, and this has aided in providing clients with a seamless process in the event of a timeout caused by slow connections.

The CABS mobile application was upgraded and now offers improved performance, faster loading times, and simplified navigation and access.

“As part of enhancing customer experience, our digital channels (USSD, WhatsApp Banking, Mobile App, and Internet Banking) incorporated additional bill payments and EazySend on their platforms,” said Mr Mpofu.

He said going forward, the society will continue to explore and implement more solutions to improve both the customer and employee experience.

Source: Herald