In the few days since Skydance Media reached an $8 billion deal to merge with Paramount Global, David Ellison said the outreach from the entertainment community has been “pretty remarkable and humbling.”

“I think there’s a great opportunity, the fact that we’ll have one of the first owned and operated studios, that will be that will be stable, that can think long term. That’s not just going to have to focus on tomorrow but can focus on several years from now,” Ellison told CNBC in an interview on Wednesday.

“We really are going to take the long-term approach to this business. And it’s been it’s been really both exciting, encouraging and humbling that the greatest filmmakers in the world and artists are supportive of this transaction. When asked by CNBC’s David Faber how “Mission Impossible” and “Top Gun: Maverick” star Tom Cruise — with whom Ellison worked on those franchises through Skydance — views the announcement, Ellison revealed that the actor is “supportive.”

“We’ve made nine movies together. He is one of the greatest most talented artists in the world,” Ellison said of Cruise. Hollywood heavyweights who have come out in support of the deal include Jane Fonda, John Krasinski, Tyler Perry and more in statements obtained by TheWrap.

Fonda, who worked with Skydance on “Grace & Frankie” and “Luck,” called the announcement a “match made in movie heaven,” adding that Ellison “deeply believes in the power of creative storytelling and creative storytellers and has the essential expertise and understanding of how technology can enhance the creative experience.”

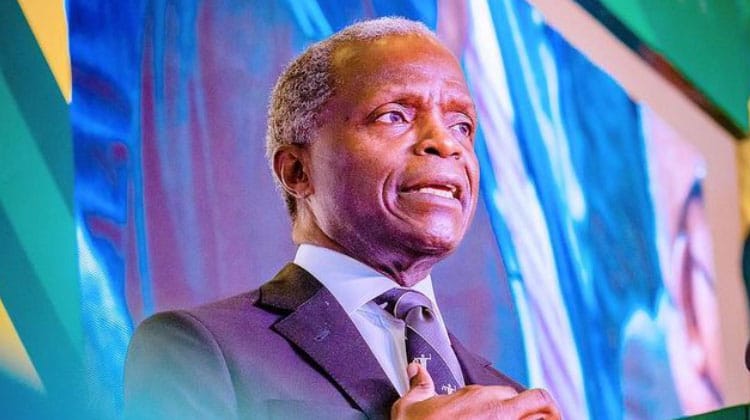

Perry said that he has “so enjoyed working with Shari Redstone every step of the way all through the Viacom to the Paramount days.”

“She has been a pillar for me, so this is a bit bitter sweet because I am equally as excited to be working with Skydance,” he added. “It is so fantastic to have someone who loves this business at the helm of one of the most storied studios. It is particularly exciting given David Ellison’s expertise in both the creative and the technological advances needed to bring us into this next chapter.”

Krasinski praised Skydance and Paramount, noting that he’s had “the good fortune” to work with both companies for nearly the past decade on film franchises like “A Quiet Place” and his Skydance-produced Prime Video series “Jack Ryan.”

“The fact that they are now joining forces ensures that I get to continue the collaboration with an incredibly talented and enthusiastic film family,” he said. Mark Wahlberg called the Skydance-Paramount merger a “win for the industry” and touted his partnership with Ellison and Skydance on “The Family Plan” and the upcoming “Balls Up.”

“David is an extraordinary filmmaker and executive, and I’m confident he’ll bring the same creative leadership to Paramount, one of the most historic studios in Hollywood,” he said. James Patterson, who’s collaborating with Ellison and Skydance on several projects including Prime Video’s “Cross,” said the team is “the right people to help fortify Paramount’s future.”

“It has been my pleasure to work closely with David Ellison and his Skydance team,” Patterson said. “They have my continued faith in adapting my work, and my heartfelt excitement for the opportunity to work with their new company.” In a statement, “Reacher” author and producer Lee Child said, “My inflexible rule is to partner only with people I like, trust and admire. David Ellison fit that bill when we teamed up many years ago, and he has proved me right many times since – he has made great decisions, and has always put the needs of the show ahead of everything else. I have had a great time with both Paramount and Skydance, and to have them combined under David’s leadership makes me very happy. Onward and upward, as we both like to say!”

In a post on X, Scott Derrickson wrote “I just completed a movie with Skydance, and here’s what I can tell you about David Ellison and his top executives: they are all smart, decent people who truly love movies.”

Under the terms of the deal, the new Paramount will have an enterprise value of $28 billion. Skydance is being valued at $4.75 billion, with its equity holders receiving 317 million newly issued Class B shares valued at $15 per share. Paramount’s Class A shareholders will receive $23 per share. Skydance’s consortium of investors will own 100% of new Paramount’s Class A shares and 69% of outstanding Class B shares, or about 70% of the pro forma shares outstanding. Paramount’s non-National Amusements Class B shareholders will receive a 48% premium to the price of the stock as of