Nvidia’s (NVDA) fiscal third quarter revenues beat Wall Street’s expectations for another straight quarter at a record $35.1 billion — up 94% from a year ago.

The chipmaker’s revenues for the quarter ended in October are up 17% from the previous quarter’s revenues of $30 billion. Nvidia reported net income of $19.3 billion, and earnings per share, or EPS, of $0.78.

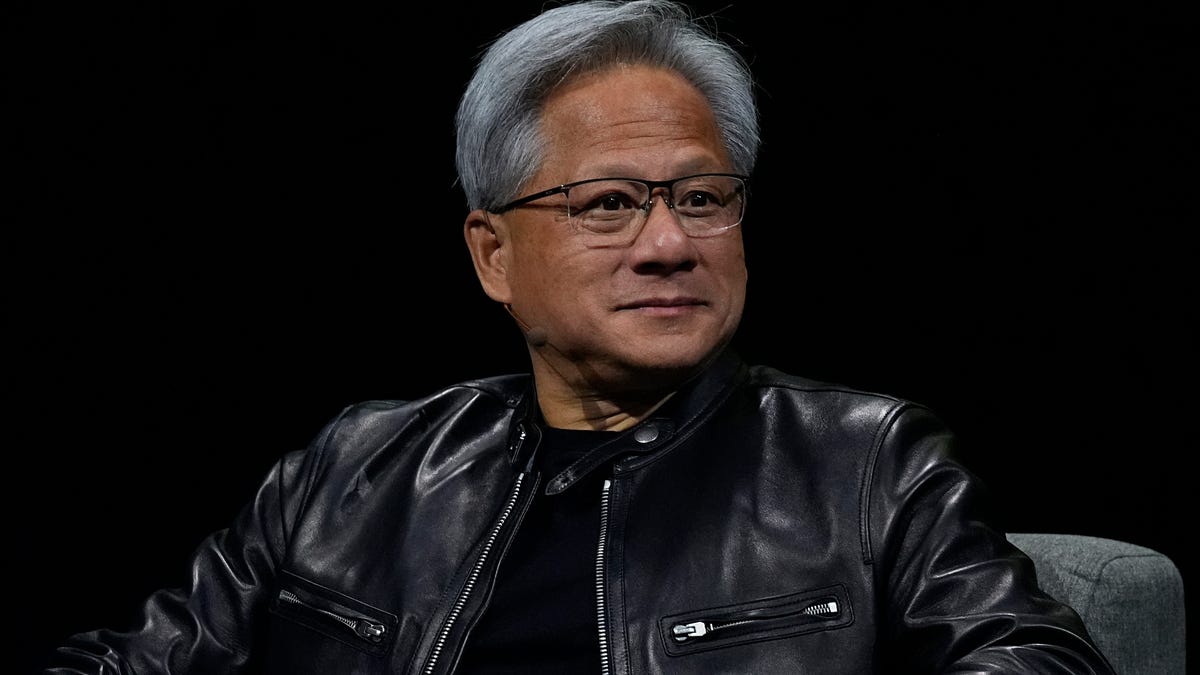

“The age of AI is in full steam, propelling a global shift to NVIDIA computing,” Nvidia chief executive Jensen Huang said in a statement. “Demand for Hopper and anticipation for Blackwell — in full production — are incredible as foundation model makers scale pretraining, post-training and inference.”

Nvidia was expected to report revenues of $33 billion for the third quarter of fiscal year 2025, according to analysts’ estimates compiled by FactSet (FDS). Net income was expected to be $17.4 billion and EPS was expected at $0.75.

Shares of the chipmaker were down 0.76% at the market close on Wednesday. Nvidia’s shares are up 202.86% so far this year.

The company’s data center quarterly revenue was $30.8, up 17% from the previous quarter, and up 112% year over year.

Nvidia set its fiscal fourth quarter revenue guidance at $37.5 billion, plus or minus 2%.

“To support the stock on earnings day,” Nvidia would have to report fiscal fourth quarter guidance of at least $38 billion, John Belton, portfolio manager at Gabelli Funds, said in comments shared with Quartz ahead of earnings.

Nvidia’s shares were down 3.47% during after-hours trading on Wednesday after it released its earnings results.

The chipmaker’s shares fell 6.9% in after-hours trading after it reported fiscal second quarter earnings in August. Nvidia had set fiscal fourth quarter revenue guidance at $32.5 billion, plus or minus 2% — slightly above the average analysts were expecting, but below top end estimates.